OK, so Brexit is a fact. This was a shock for markets, you can see clearly on charts that traders were expecting that UK will remain in EU. After decision about leaving was official, we saw some serious strong moves.

During next days and even months we can see more strong moves. In my opion it is crucial to pay attention to weekly and monthly pivot points. You can see later in examples that pivot points worked, even when news came out and we saw rapid moves.

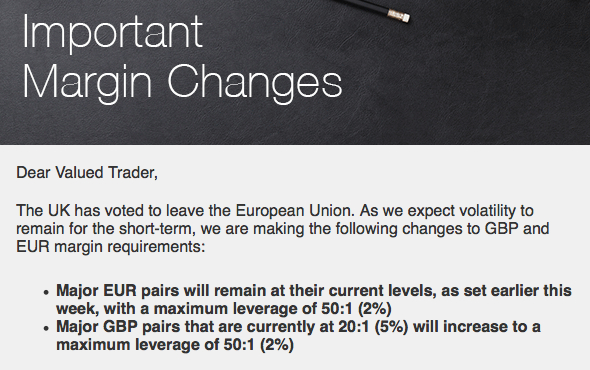

Changes in forex brokers regulations

It is interesting that we saw many changes made by forex brokers like new margin requirements and others:

It is a good thing. Nobody can predict exactly how euro, pound and other pairs will react.

Eur/gbp

Now this pair will be almost as important as eur/usd ;). After decision was published, eur/gbp went up from 0.76 to 0.83. We can see clearly that top was at monthly R3 line but it closed right at R2 line:

As I wrote, pivot points will be crucial in next months. It is a good news for us that even during such drastic situation we can rely on pivot lines.

Which pivot are best – daily, weekly or monthly?

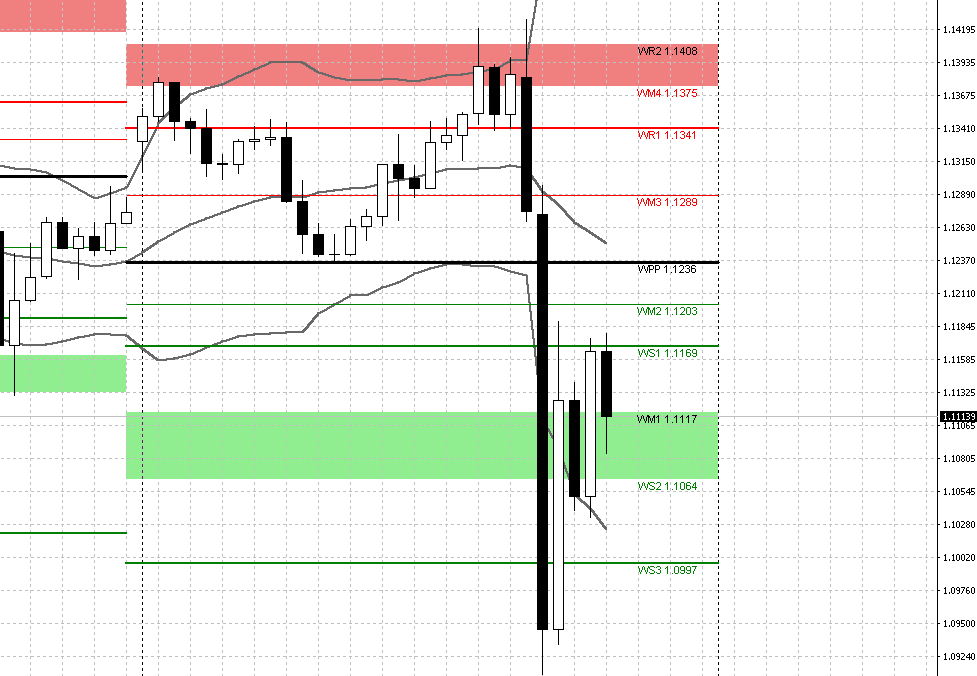

It depends from your trading strategy. Daytraders will watch mostly daily pivots. Swing traders and longer term traders will watch weekly and monthly pivots. I trade recently mostly swing moves on 1-hour time frame and weekly pivots are most important for me. But… there are days like last Friday. Price moves above or below weekly support and resistance lines like on this eur/usd H4 chart:

When you see something like that, you switch to monthly pivots (or you can draw both on one chart). Check the same chart for eur/usd with monthly pivots:

Eur/usd

When we place monthly pivot lines on eur/usd we can see that move lasted down to the monthly S1 line and this was a support:

Why this is important for us? Because we can use that knowledge to take profits. Basically the plan is to close part or whole trade at important turning points. We can see that when S1 was hit there was a strong correction up.

Aud/usd

Here we can clearly see that weekly R3 line was a resistance and move went down to the weekly S1:

Download pivot points

If you want to use same daily, weekly or monthly pivot points in your Metatrader, you can download Pivot Points for Metatrader here.

What about Fibonacci lines?

I still use Fibonacci in my trading together with pivot points. In this post I just wanted to focus on pivot points.