It was all about euro after Greek voted for Syriza. This is a bad result for eurozone, because Syriza party wants to drop euro and go back to drahma. Eur/usd started day with a huge gap and all economy portals were reporting about euro getting hammered. What is interesting, 1.11 support hold and we saw a bounce back. Below 15 min. eur/usd chart:

As you can see, there was even a nice long setup.

When we check higher time frame (4hr), we can see that correction up to 1.14 is possible. Of course this is a strong downtrend so this is only a talk about potential target for correction. 4hr eur/usd:

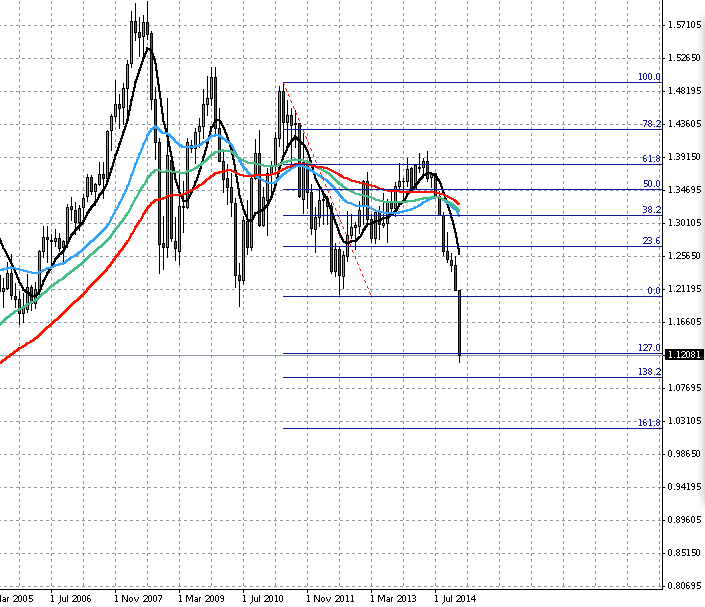

I mentioned yesterday that on monthly chart we are at 127% extension line and price may stop here for a while. I believe that this is one of few reasons why 1.11 did hold. For how long? We will see :). Monthly eur/usd with 127% extension:

gbp/jpy

This pair was going down in last few days and today it looked for a moment that there might be a continuation of that move. In the morning we saw a strong move up which lasted up to weekly pivot point (blue rectangle). This was a strong resistance for a while and price retraced to the 38.2% retracement line. A nice ABC pattern, where you could look for long opportunities. It was best to wait for move back above weekly pivot to have better chances. As you can see, buyers forced weekly pivot line and price managed to go to the 161.8% extension level. I catched that move and I’m pretty happy with results. Below 15 min. gbp/jpy:

DAX

DAX is going north strong, not a place to look for shorts (at least for now). Below daily DAX:

Swiss pairs

After all drama about swiss, we can see some strong correction up on swiss pairs, especially on usd/chf:

I hope that you had a profitable day. Good luck tommorow!